Your personal credit history indicates your trustworthiness for paying your debts and bills on time and in full, regardless of which institution you obtained the financing from. You build credit when you take out a loan to buy a car, apply for a retail credit card, or get approved for student loans to finance your education.

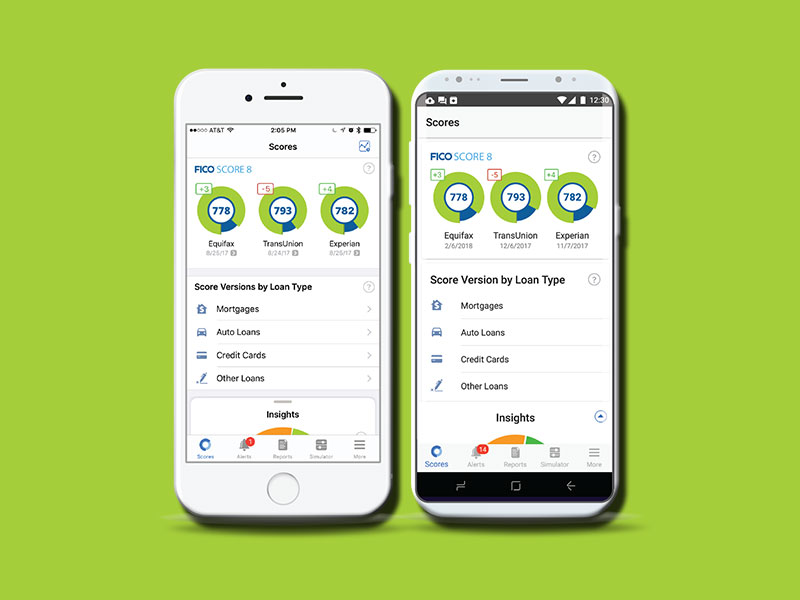

While a credit report shows your credit history, the information is also used to generate both a credit score and your FICO score. With myFICO, you can monitor and track your FICO score, as well as receive credit report updates.

Table of Contents

What Is myFICO?

Through the service established by the trusted FICO brand, users are able to access their FICO score. This is the credit score that a majority of top lenders use to determine creditworthiness. The service also has the added benefits of identity restoration assistance and identity theft insurance. Through the tiered plans, users are able to customize their interest in protecting their credit and building their credit score.

Your personal FICO score is a three-digit number determined by the data found on your credit report. Lenders will use this number to help decide if you are likely to repay borrowed money. Your score also impacts how much money you can borrow, how long you would have to pay it back, and the interest rate for the loan.

The credit application process has become more efficient through the use of credit scores, and the FICO score. It presents a quick snapshot of your total credit report.

Snapshot of Your Credit Report

A FICO score will tell a lender the basics about your creditworthiness. While it’s just a number, it is based on the key areas of credit reporting. The FICO score is also slightly different than a VantageScore, as the Fair Isaac Corporation developed the first FICO scoring model and uses five categories of information to determine your score.

The VantageScore model is the result of a collaborative effort between the three big consumer credit bureaus of TransUnion, Experian, and Equifax and includes six categories of information. The categories are also weighted differently.

FICO Scoring

Though the details of your specific credit history will determine your score, FICO modeling relies on five categories. It create the actual score that myFICO keeps watch over. The numbers will range from 300 to 850, with the higher numbers indicating a more favorable credit rating. There are industry-specific ranges that go from 250 to 900, but higher scores still reflect creditworthiness. The categories for scoring include:

- Credit mix, totaling 10% of the score

- New credit, providing 10% of the score

- Length of credit history, equaling 15% of the score

- The amount owed across the open accounts, equating to 30% of the score

- Payment history, accounting for 35% of the score

FICO puts the scores into ranges, though individual lenders can form their own standards for creditworthiness:

- Exceptional ranges 800 to 850

- Very good is from 740 to 799

- Good falls between 670 to 739

- Fair is between 580 to 669

- Poor runs from 300 to 579

Good credit leads to more borrowing opportunities. It indicates a low level of risk for a financial institution or lender.

Why Is myFICO Important?

In broad terms, myFICO is a credit monitoring service. With this service, you can more effectively keep track of what is going on with your credit report. You can have an early warning system in place to catch potential signs of reporting mistakes or identity theft. According to the Federal Trade Commission, identity theft is the number one incident reported each year concerning consumer fraud.

Identity theft is not the same as credit card theft. Though both are serious situations that can wreak havoc on your life and personal credit.

Identity Theft and Credit Card Fraud

The ultimate consequence of falling victim to either credit card fraud or identity theft is the destruction of your credit and erosion of your financial stability. Credit card fraud could be a stand-alone occurrence, or it could be a by-product of identity theft. In credit card theft, an individual steals your credit card information and makes unauthorized purchases either online or in a store.

With identity theft, all of your personal identifier information is compromised. They are used to establish lines of credit or to obtain false identification.

With credit card theft, you may only be responsible for a minimum liability charge if you can show that someone stole the card information. Even if the thief was able to charge thousands in purchases, you might not have to pay anything to the company apart from the liability fee. The rest of the charges are often dissolved due to the theft.

However, when someone steals your identity, there is no liability fail-safe. You could be responsible for any of the activities that took place under your name. It costs you thousands of dollars and ruins your credit in the process.

How Credit Monitoring Helps With Fraud

Few people think about their credit and identity on a daily basis. This is why a service like myFICO is so important. It is a lot easier to catch situations of fraud or identity theft when there are protective measures in place. There are some protections offered by credit card companies, such as notifications of suspicious transactions.

Activity in foreign countries often signals a red flag. Many times a credit card company will send an alert requesting verification of usage or personal information.

Identity theft isn’t always used for purchases. Thieves will take the information to enroll in health care services or to open a line of credit for a larger transaction like a mortgage or vehicle loan. The thieves could even use the information to file taxes or collect social security benefits.

It could take years before you notice that there are issues with your identity, though changes on your credit report are some of the earliest signs things aren’t right.

Though there are a number of tips that can help you identify and protect yourself from fraud, you can have greater peace of mind when you know there is a dedicated service keeping track of your credit for you. Fraud prevention and early intervention can save you a lifetime of headaches and thousands of dollars.

Build Credit

In addition to acting as a safeguard against fraud and theft, myFICO can also support you as you try to build and maintain strong credit. Your creditworthiness will impact many of life’s biggest decisions, which makes working on your credit a lifelong task. Your credit score may affect whether you receive favorable lending rates, land your dream job, open a utility account or qualify for a mortgage. Credit is hard to establish and easy to lose.

Many people make decisions without understanding the impact on their credit score. This is where a credit monitoring service can help.

In addition to alerting you of a hard inquiry or a new credit account opened under your name, you can use a monitoring service. You can access all of your financial information in one place. This presents you with the details needed to clean up any issues with your credit report. It provides the insight necessary to drive your score higher.

Credit Report Elements

There is a lot of information on your credit report. In addition to the personal identifying details on your account, the most basic information about your financial past includes a list of all your credit accounts. With each credit limit, account types, whether open or closed, and the payment history for the accounts. Equifax, Experian, and TransUnion are the three major credit bureaus. They compile the information about your credit history, and there may be some slight discrepancies between the reports issued.

However, the basics of your history should be consistent, and four fundamental categories of information are presented.

Using myFICO To Improve Creditworthiness

Because a credit monitoring service is for consumer use, you have instant access to the information that can help or hurt your creditworthiness. Building credit and protecting yourself from identity theft means putting the information you receive from myFICO to good use.

Preventing Theft

With identity monitoring, myFICO notifies you if your information is compromised. So you can take steps to recover from acts of theft. However, there are several things you can do on your own to reduce the risk of being a victim of identity theft:

- Collect your mail every day to avoid someone stealing your utility bills, credit card or bank statements, or preapproved credit card offers.

- Review your bank and credit card statements every month for unauthorized activity.

- Create a unique, complex password for each separate personal account and avoid using any personal identification information in the password.

- Always shred documents containing any personal information before throwing paperwork away. But keep at least three months of current bank and credit card statements, utility bills, and any other documents with your personally identifying information on hand.

- Install antivirus and other protective software across your electronic devices to avoid falling victim to spyware, malware, or viruses.

- Carefully wipe any electronics back to factory settings and erase all hardware before donating or throwing away.

- Boost your protection by enabling two-factor authentication across your electronic accounts and devices.

- Opt-out of any prescreened lending offers to reduce intercepted mail and email hacking.

Boosting Credit

By being able to view your credit report, you will see the factors that could impact a lender’s decision. Low scores can improve dramatically if you identify what is bringing the score down. When you know which category weighs the heaviest on your score, you can address that negative area first for a faster score improvement.

However, a lifestyle of good personal finance habits can not only raise your score. It also helps you maintain a ranking in the excellent credit range. The following habits will have a noticeable impact on your FICO score:

- Pay every bill on time. Whether it is a utility bill, mortgage, student loan, or credit card payment. Since this factor is the most important when determining your score.

- Strategically pay down your credit balances, as lowering credit utilization is the second most influential factor on your score.

- Open a dispute for any errors that appear on your credit report to avoid negative marks bringing down your score.

- Develop a mix of secured and unsecured credit lines, becoming an authorized user or utilizing a credit-builder loan to help establish a favorable credit mix.

- Prioritize past-due or collection accounts to avoid further damage to your credit history.

- Limit how often you apply for new credit. But keep in mind that rate shopping isn’t always a detriment when looking for a mortgage or auto loan.

Making myFICO Work for You

When you choose to let myFICO help you take charge of your credit, you gain access to numerous tools and resources. They develop positive credit skills and empower you to reach your financial goals. You can use the FICO Score Simulator to conduct a simulation across the three major credit bureaus for paying down an open account, taking out an auto loan, or making other credit decisions.

Can see the most up-to-date rates for auto loans or mortgages based on your current FICO score. You can ask questions in member user forums or contact the U.S.-based customer support team.

You have three plan options with myFICO, moving from Basic to Advanced and on to Premier. Under Basic coverage, you receive Experian credit report coverage, while the other plans provide three-bureau monitoring. You are also eligible for identity monitoring through the Advanced or Premier plan.

Educating Yourself With myFICO

For more information on myFICO or other effective ways to address your creditworthiness, check out the tools and resources offered by Fiscal Tiger. The more informed you are concerning your credit and how to manage it properly, the better your financial position will be when it’s time to put in a credit application or make a major life purchase.