Learning how to write a check is a valuable life skill, but — like taxes and credit scores — it is rarely a topic taught in school. And in our modern world, many believe that checks are becoming obsolete as technology and the wallet evolve. However, there are still times when checks are the only method of payment that will work, and people aren’t always prepared to fill them out correctly.

Here at Fiscal Tiger, we’ve given quite a few tips on checks — how to cash a check (even without a bank account) and where to deposit them when banks are closed. Now we’ll cover how to properly write a check.

Whether you’re filling out checks for rent, trying to pay medical bills, or you’re sending a check to a relative or friend for their birthday, here’s everything you need to know about how to correctly fill out a check, step-by-step.

Table of Contents

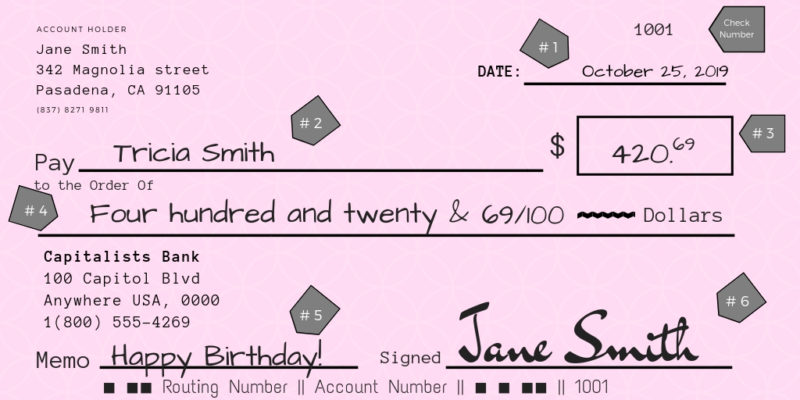

Example of a Proper Check: What to Write

Writing out checks is an essential skill to learn, and the more often you do it, the more natural it will become. Here is a step-by-step guide on how to correctly fill out a check:

Current Date (#1)

Near the top right hand corner of the check (below the check number) is the line for you to write out the current date. This is used to help you and the payee keep an accurate record of when the check became legal tender.

What does it mean to postdate a check?

Postdating a check is a common occurrence where people will write a future date on a check instead of the current date. Some people will use this to determine when a check should be cashed. However, it’s important to keep in mind that the moment a check is signed, it becomes legal tender. The date on the check does not determine if or when a check can be cashed, and it is solely used for personal notation so you can better keep track of when you paid a bill or signed a check.

If you do not have the funds available that is required for that check, then do not write the check until you have the funds. Bouncing a check can often cost you a lot more in the long run, as your bank may charge you an “insufficient funds” fee (anywhere from $20-$70), the payee or company may charge you a “bounced check” fee (anywhere from $20-$40), and large amounts that are bounced may result in a lawsuit or legal action against you.

Some states also have varying laws around postdating a check, so be sure to not fall into legal trouble if you live in a state that makes postdating an illegal act. In general, it’s best to be direct about the date you wrote the check.

Pay to the Order Of (#2)

Below your personal information, near the center of the check, is the line for the payee: either a person or an organization. The check will often read “pay to the order of” or something similar near this line.

Be sure to be as clear as possible when writing out your check and avoid using nicknames or shorthand names, as this can open up chances for fraud or theft. If you’re unsure of who to make the check out to, simply ask the recipient what you should put on that line or “Who should I make this check out to?”.

Amount in Numerics (#3)

Near the end of the payee line, on the right hand side of the check, will be a box with a dollar sign next to it. This is where you will write out the amount for the check in numeric form.

Be sure to write this out as legibly as possible, and draw a line after the amount if there is extra blank space in the box. Drawing a line can help prevent fraudsters from making the check out for more money than it was intended.

Written Out Amount (#4)

Below the payee line is another line for you to write out the amount of the check in full, this time by using words instead of numerics. This is to help clarify the total amount the check is actually worth.

If the amount is large — such as $1,456.87 — you would write it out in full as “one thousand four hundred fifty six & 87/100 ~”. The cents part of the total is often kept in numerics, as a fraction over 100, to separate it from the overall total (otherwise it might appear as larger sum than you intended).

It’s important to note that the amount you write out in words is the legal amount for that check. If it varies from the numeric amount written in the box, then the bank that is cashing the check will only rely on the written out amount.

Because of this, write the amount out as legibly as possible, and draw a line after the full amount if there is extra blank space the written amount and the “dollars” print at the end of the underline. Drawing a line to fill that space can help prevent fraudsters from making the check out for more money than it was intended.

Optional Note or Memo (#5)

This line is optional and will not affect how, when, or if the check should be cashed. However, it’s also a good idea to utilize the “memo” or “note” line in order to better track your checks. On this line you can write anything from “happy birthday” so the payee knows it’s a gift, to “Rent for August 2019” so you know what that check was for when you look back at your check ledger. You can even provide additional information that serves both parties, such as your account number for the utility company next to “January Water Bill”.

After you’ve written the check, be sure to write a similar note in your check ledger or register to remind yourself of the purpose of that check (see below section for more on ledgers).

Signature (#6)

The final line, on the bottom right of the check, is intended for your signature. Once your signature is on the check, that check becomes legal tender and is just as good as cash.

Much like when signing off for a credit card transaction, the signature is a way for you to determine that you authorized this transaction — but the banking institution either cashing the check or in charge of your bank account may not double check that your signature is the same. It’s a safeguard set up for you, but you may be the only one who will determine if a check is fraudulent or not. Once you raise the alarm, the bank can then do their work in order to protect your assets.

Again, do your best to keep your signature consistent, as any changes or funny doodles can make it more difficult to determine counterfeit checks from real and authorized ones.

After Writing Your Check: the Check Ledger or Register

When you order checks from your bank, it oftentimes comes with some additional slips, such as deposit or withdrawal slips, and what is known as a check ledger. The check ledger — also known as a check register (see example below) — is a lined sheet that is intended to help you better manage your bank account and checks.

There are many benefits to utilizing your check register, such as:

- Preventing you from paying a bill twice.

- Preventing you from overspending or “bouncing” a check.

- Helping you better manage your finances and keep track of what checks you’ve written and if they’ve been cashed/processed yet.

- Helping you track check numbers, amounts, and more in case your information is stolen or a fraudulent check is made under your name.

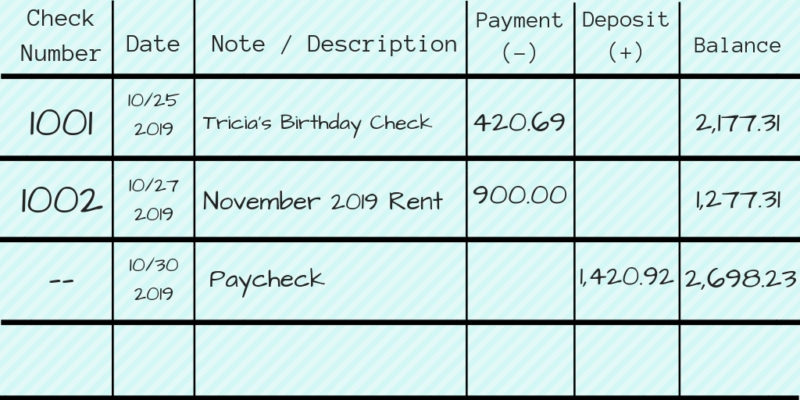

Check Register Example

The above is an example of what your check ledger or register may look like.

When filling out your check ledger, the most important items you should note are:

- The number of your check

- The date you wrote the check

- The payee or a description of the check’s purpose

- The amount of the check

- And how much is leftover in your bank account after the check goes through (your remaining balance)

Some bank ledgers will have additional spaces for you to fill in more information, such as a column labeled with a check mark (?) to note that the check has been fully cashed and processed through your bank.

If you want to use your check register to manage your bank account, you should also keep track of any spending done with your debit card or with cash. Additionally, you should note when money is deposited into your account, as the example above shows with the “paycheck” in the third row.

Where to Get a Check Register or Ledger

As mentioned, a check register often comes with the checks you order from your bank. However, you only get so many pages, and if you run out of room, you may need to order more. Luckily, there are plenty of ways to get check registers for free, and you can even make your own by drawing out a grid on paper.

There are also plenty of online resources at your disposal. You can find free printable templates online — such as WalletHub’s printable register — or you can utilize verified and safe online applications — such as Mint or Quickbooks — that are specifically designed to help you budget your finances by electronically monitoring your bank account and transactions. If you do decide to use an online app, make sure that it is verified safe with your bank, and do your research online to ensure those applications will fit your needs.

However, keeping a personal register can still be beneficial so that you can double check your information, ensuring that both you and your bank are on the same page when it comes to cashed checks and your remaining balance.

Security Tips for Your Check

If you find you still need to write a check for whatever purpose, then there are some additional steps you can take to make sure your information stays safe and your check is utilized for the proper purpose. Here are some security tips for writing checks:

- Write With a Pen: It is always best to write out checks with a pen that cannot be erased. Writing a check in pencil or erasable pen opens up the possibility for that check to be altered by either thieves, or the person who the check is addressed to. They can change the payee name or the amount the check is for, and since your signature is on the check, it is already legal tender. Avoid this possibility by using black or blue ink pens instead of any non-permanent ink or pencil.

- Always Fill Out the Check Completely: The 1994 movie “Blank Check” might be a clever idea for a movie, but is not something you want happening to yourself. If you fail to fill out a check completely, others could potentially alter the check to be worth more money or to be paid to a different payee. Be sure to fill out every section of the check to avoid this possibility.

- Don’t Write Checks for “Cash”: Another common security issue is when people write out “Cash” on the “Pay to the Order of” line of a check. This is one way to get cash out of your own bank account, or to write a check when you don’t know who the payee is or how to spell their name. Since your signature is on the check, it is just as risky as carrying around wads of cash, and makes it possible for anyone to cash it. Avoid doing this, and instead just use your debit or ATM card to withdraw money when you’re at the bank, ATM, or at a grocery store.

- Write Legibly: Everyone’s handwriting is different, and not everyone has perfectly legible handwriting. However, when it comes to writing a check, illegible handwriting can hamper the ability for the bank teller to determine how much the check is for and the payee name. Do your best to write legibly, as illegible handwriting can easily get misinterpreted or could potentially open up the possibility of someone forging the check for more than it was intended. Additionally, you can avoid people writing out the check for more money by drawing a line in the blank space across the written out dollar amount after you’ve written out how much the check is for (see #4 on the check example above).

- Keep Your Signature Consistent: Your signature is one of the only protections you have for identifying fraud, so it’s important to make sure you always use a consistent signature or initials. Although it might be clever or cute to draw a smiley face or image on the signature line, it can cause issues for both yourself and your bank if there’s ever a fraud alert on your account.

- Limit How Many Checks You Write: As stated above, checks aren’t always the best way to pay for services or to gift money — there are many other safe and convenient options out there. Even though online payments may seem prone to risks, there’s no paper trail that can get lost in the mail, stolen or peeked at by thieves, or altered by fraudsters. Plus, modern conveniences have changed the way banking works, and even though it may seem as if checks are old-fashioned, many companies process checking information electronically — so you’re really not avoiding technology by writing a check. If you can, find an alternative for checks, and you could potentially save yourself both time and trouble.

Alternatives to Writing a Check

Before you set pen to paper and write out your check, it’s important to think of other options for how to pay someone the money that you owe. Checks can be a nifty way for you to keep track of your spending, but there are many safer and faster ways for you to either pay the bills or get money to family members for gifts.

Checks also include a lot of your personal information — your name, address, phone number, and your bank account and routing number — which means there are more opportunities for identity theft with checks than most other forms of payment.

If there are other options available to you, you should certainly consider them before you send a check. First, define the purpose of your check, and then consider trying these alternatives if they apply to your situation:

- Paying Bills: If you’re writing a check for rent or your monthly bills, there are plenty of other options available. Rent can be tricky, as it is up to your landlord or property manager to set up potential alternatives for payments, but other monthly bills such as utilities, medical bills, or mortgage payments can often be paid through online portals set up with the company. If you haven’t already researched your options, visit the website of the company you are supposed to be paying, and see if they have an online system for payment. This can be much easier than mailing a check, and a lot safer for your personal information.

-

- Alternatively, if the company you’re paying is going to require regular payments on a monthly basis, and they have an online payment portal, then you may be able to save yourself some time by setting up automatic payments. Creating an automatic payment can help in many ways, as you won’t have to worry about forgetting to make payments, can protect your credit score by not having late payments or having your account go to collections, and you can better budget by knowing when your bills will be paid. Of course, setting up automatic payments also has its downsides, so be sure to research if it’s right for you.

- Sending a Gift: Money is a common gift for friends and family members, and writing a check may seem like a sincere way to send them money, without actually sending them physical bills. However, checks are legal tender the moment they are signed, and the amount of personal information on that check could put your financial accounts at risk. Instead of risking the possibility of identity theft, you could always send gift cards instead. Visa, American Express, and Mastercard — some of the main credit card networkers — all offer their own version of gift cards that work just like a credit card, meaning they can work anywhere where credit cards are accepted. These gift cards only require a small activation fee (which you pay when purchasing the gift card), and could keep your personal information safe and out of the hands of potential identity thieves. There are also many ways to send cash via services like Paypal for free online.

- Purchasing Items: If you’re writing a check for a simple purchase in a store, there are much faster and easier ways to pay for your purchase than through a check. Even if you don’t have a credit card or bank (debit) card, you can still use cash and not have to worry about filling out a check while you’re at the register purchasing your items. Checks take much longer to fill out, and many companies don’t accept checks as payment due to the long processing time and the potential for large fees if the check “bounces” (meaning your bank account has insufficient funds to fulfill the amount requested on the check).

Image Source: https://depositphotos.com/