If you’re like most people working for a for-profit company, you may see small deductions from your paycheck to your 401(k). If you’ve opted in to contributing to your 401(k), you’re probably already aware that you’re building up for your retirement savings plan in some way.

However, do you know exactly what a 401(k) is and how this plan can benefit you? Learning more about your 401(k) retirement savings plan can help ensure you’re taking advantage of all the benefits this retirement vehicle has to offer.

Table of Contents

What Is a 401(k)?

A 401(k) retirement plan is considered a “defined contribution” retirement plan by the Internal Revenue Service (IRS) because the contributions your employer makes to the plan are predetermined. Only some employers offer 401(k) plans to their employees.

401(k)s are similar to pension plans, which are usually only offered through government employers. Since your contributions to your 401(k) retirement plan are taken directly from your paycheck, it’s one of the easiest ways to begin saving for retirement.

How Does a 401(k) Plan Work?

The point of a 401(k) retirement plan is to continuously add money so it can grow over a long period of time. The money you add to your 401(k) is invested in mutual funds, which should contribute to this growth.

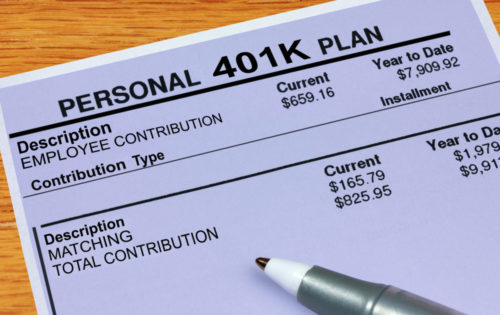

One of the benefits of a pre-tax 401(k) plan is that the money you contribute is taken directly from your paycheck before taxes, so you’re getting a tax break on your contributions. Some employers also match the amount you contribute up to a certain threshold.

How to Open a 401(k) Plan

If your employer offers a 401(k) retirement plan, you sign up and choose where you want your money invested and the amount you want taken out of each paycheck. If your employer doesn’t offer a 401(k) retirement plan or you’re self-employed, there are other ways you can invest in your retirement, such as an Individual Retirement Account (IRA). While your contributions are not matched by an employer, you’ll still benefit from tax breaks from the IRS.

Contributing to Your 401(k) Plan

It can be hard to decide how much to contribute to your 401(k) retirement plan each paycheck. Ask yourself these questions when deciding how much to contribute:

- How much can you afford to contribute from your paycheck?

- How much does your employer match?

- How much will you need in retirement?

While you want to build your 401(k), don’t contribute so much that your paycheck no longer covers your monthly expenses. Since the employer contribution match is basically free money, you should consider contributing enough to obtain the full match contribution. You should also analyze how much you’ll need in retirement and the other retirement vehicles you have when deciding how much to contribute to your 401(k).

How Much Can You Contribute a Year?

The 2020 contribution limit for a 401(k) is $19,500. Employees who are 50 years of age and older have a “catch-up limit” of $6,500, so they can contribute a total of $26,000 for the year.

Matched 401(k)

If your employer offers a 401(k) retirement plan with matching, it means the employer will match the amount you contribute to your plan. However, there are limits to how much an employer will match. According to Fidelity, the average employer contribution rate in the first quarter of 2019 was 4.7% of employee salary.

Can You Withdraw Your 401(k) Early?

In some cases, your employer may allow you to pull from your 401(k) retirement plan early. However, you’ll face tax penalties if you do pull from your account before retirement. It’s best to weigh the pros and cons of early 401(k) withdrawals before making a move.

Advantages of Withdrawing From Your 401(k) Plan Early

While you may face tax penalties for pulling your money out early, sometimes it can benefit your financial future if you need the cash right away. You may need to use your 401(k) retirement plan to buy a house if you’re having trouble saving for a down payment.

If you’re in a bad financial situation, your employer may allow you to make a 401(k) hardship withdrawal from your retirement plan. However, you may only qualify if you need the money for medical expenses or burial expenses for a loved one. This type of withdrawal could also help you avoid foreclosure on your home.

You may also need to make an early withdrawal to pay for your education. While you can pull from your 401(k) to pay for education and avoid student loan debt, you’re still subject to tax penalties for withdrawing money early.

Disadvantages of Withdrawing From Your 401(k) Plan Early

When you withdraw money from your 401(k) plan early, it’s important to note that:

- Your 401(k) retirement plan will immediately shrink.

- You must pay income tax on any money you take out.

- You may also be required to pay an additional 10% tax on the money you take out.

- If you received a hardship distribution, you can’t contribute to your account for six months after the withdrawal.

401(k) Tax Rules

When you contribute money to your 401(k), you don’t pay taxes on the income you put into the retirement plan. The money you make when investing in this vehicle is also not taxable until you retire and receive distributions.

If you make an early withdrawal from the account, you’re subject to both income tax and potentially an additional 10% tax. However, if you wait until you’re 59.5 years old to begin receiving distributions, you’ll only pay income tax in retirement. If you live in a state that doesn’t require income taxes, you don’t owe any taxes on your distributions.

Why Should You Have a 401(k) Plan?

A 401(k) retirement plan is a convenient way to save for retirement.

Advantages of a 401(k) Retirement Plan

- Contributions are taken directly from your paycheck.

- Your employer may match your contributions.

- Your contributions are made before taxes.

Disadvantages of a 401(k) Retirement Plan

- Your paycheck is lower when contributing to a 401(k).

- You’ll pay taxes for early withdrawals.

- You have contribution limits.

If your employer offers a 401(k) retirement plan, you may want to consider contributing to it, especially if employer matching is offered. When you understand how this investment vehicle works, it can be a convenient and simple way to get to retirement faster.

Image Source: https://depositphotos.com/