You may find that an ABA routing number is required when you go to perform certain financial interactions. This might come across as technical financial jargon, but an ABA routing number is actually a simple, commonly used item in the banking world.

Also referred to as an RTN (routing transfer number) or simply a routing number, an ABA routing number is a nine-digit code that is used to identify a banking institution.

The acronym “ABA” stands for the American Bankers Association, as ABA numbers are exclusively assigned to financial companies within the United States. The first routing numbers were created in 1910 by the ABA to help clarify the confusion that had been caused by written checks. Since then they’ve come to be utilized with many other financial transactions of both a digital and physical nature.

How to Find an ABA Routing Number

If you’re wondering how you can find the ABA routing number for your own bank, there are a few ways to do so:

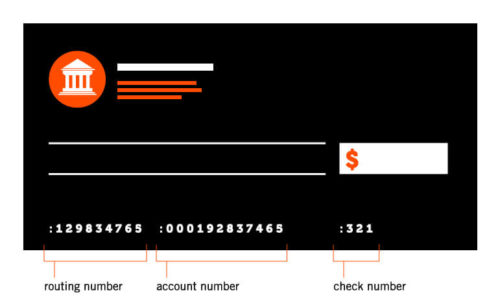

- Paper checks: The first option is to look at a check from your bank. Your routing number will be located in the bottom left-hand corner. Typically it’s next to your account number and check number. The routing number should always be the nine digits farthest to the left.

- Contact your bank: The second option is to contact your bank directly. You can do this via a phone call, email, or even an online chat. You may have to answer a few security questions first, but a customer support representative should eventually be able to give you the routing number you’re looking for.

- Find it on your bank’s website: Many banks will keep their routing number on their website. Sometimes it’s right on the site’s header, footer, or a public page. At other times you may have to log into your online bank account to access the information.

- Check the ABA website: If all else fails, you can find your routing number on the official ABA website. Simply agree to the terms and agreement form to access the search engine and then enter your financial institution’s name, city, state, and zip code.

- Conduct an online search for your bank’s routing number: Many sites provide the routing numbers for specific banks and credit unions. Simply Google your bank’s name and the term “routing number” and see if you can locate what you’re looking for.

When Is a Routing Number Used?

Routing numbers are used for a wide variety of financial interactions. They help banks identify who is sending funds, receiving funds, or both. Some of the most common uses for routing numbers include:

- Electronic funds withdrawals.

- Transferring money between banks.

- Automatic bill payments.

- Online and ACH (automated clearing house) payments.

- Processing checks.

- Wire transfers.

- Direct deposits.

- Paying taxes.

Typically when a routing number is requested, it must come from the bank where an individual originally opened their account, not their current location.

Routing Number vs. Account Number

There are typically three numbers on the bottom left-hand side of a written check. The shortest of these is usually the check number, and it is simply the number of the check being written. However, the two remaining serials can be both long and confusing.

The one on the right is an account number, and it signifies the individual checking account from which funds are being drawn or to which they’re being deposited. This number helps to identify the individual or business that has a claim to the funds and is performing a transaction.

The left number is the nine-digit routing number. This ABA number distinguishes which bank, credit union, or other financial institution is performing the transaction of transferring the funds.

Both numbers are critical pieces of a successful transaction and must be properly identified when providing information to a financial institution.

Image Source: https://depositphotos.com/